This chart shows why the Fed’s rate-hike campaign hasn’t generated a recession

One of the enduring puzzles of the current economic strength is how little impact the Fed’s rate hikes seemed to have caused — not generating the recession or crisis that every previous hiking cycle over the last 70 years has done.

The hikes, from zero all the way up to the current range of 5.25% and 5.5% in just a year and a half, did impact parts of the economy: new-home sales, for instance, slumped from an annual rate of 830,000 just before the rate hikes to as low as 543,000, and are still only at 661,000. Manufacturing production has basically flat-lined, and only now are there signs of it improving.

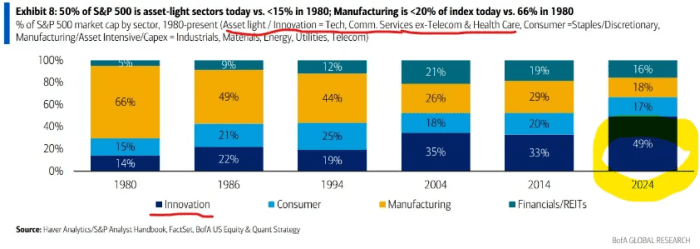

But the U.S. economy just isn’t that interest-rate sensitive anymore. Moses Sternstein of the Random Walk blog shared this chart, originally produced by Bank of America, showing the percentage of the S&P 500

SPX

made up of what it calls asset-light sectors, which include technology as well as health-sector companies.

And while that’s just the stock market, the broader economy is also less capital intensive.

He said the real impact of higher interest rates on tech companies is that it made them more efficient. Sternstein noted that tech companies as rates started rising focused more on cash flow over sales growth. “Investors may not love it because while profit is fine, growth is the sexy part, but from the standpoint of ‘wheels staying on the economy,’ then profit works just fine,” he writes.

As for the market, Sternstein shared a chart of the spread between B and BB rated junk bonds getting tighter. “Either a wicked-dead cat bounce with lots of egg on everyone’s faces, or doggone it, we’re off to the races again,” he said.

The S&P 500 ended February at a record high after a 5.2% surge, and the index has climbed 21.5% over the last four months alone.

Source link

:max_bytes(150000):strip_icc()/GettyImages-2149425278-10b7e09c3986402ab8fa5ae540068c9d.jpg?w=390&resize=390,220&ssl=1)

:max_bytes(150000):strip_icc()/INV_StrategicPetroleumReserve_GettyImages-1434804700-930b2f63ac494dccb1223603d993391a.jpg?w=390&resize=390,220&ssl=1)