HFZ developer Nir Meir Is Facing Charges of Fraud.

Photo-Illustration: Curbed; Photos: Alamy, Curbed

Even by the standards of the Manhattan real-estate industry — a field long associated with money laundering, organized crime, and Trumps — Nir Meir’s alleged crimes stand out for their breadth and brazenness.

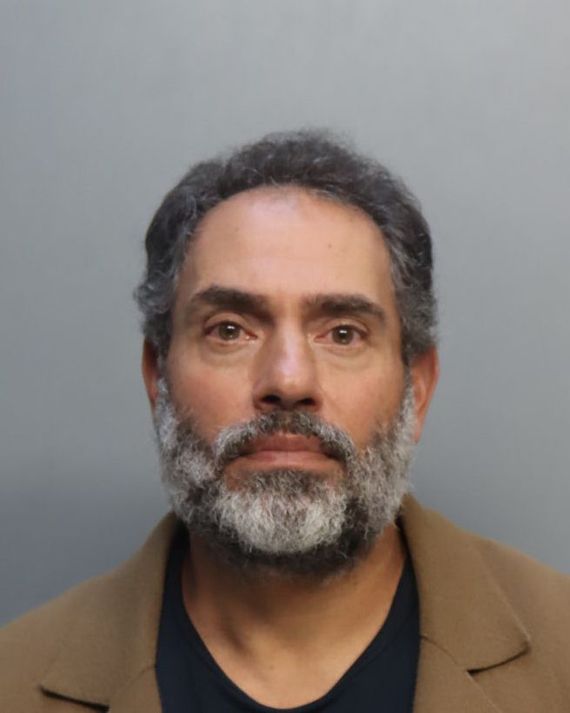

Meir, the former managing director of the luxury developer HFZ Capital Group, will be arraigned today before a judge in lower Manhattan, following his arrest in Miami earlier this month. He’s facing a raft of charges, including grand larceny, conspiracy, and forgery, that are the result of a three-year joint investigation by the district attorney and the New York State Police Special Investigation Unit. Two of Meir’s colleagues at HFZ and three employees of Omnibuild, a construction management firm, were arraigned two weeks ago.

As HFZ’s managing director, Meir, 49, was second-in-command to the firm’s founder, Ziel Feldman. Fifteen years older than Meir, Feldman was something of a ruler in absentia, happy to let his protégé manage the firm’s day-to-day operations. Prosecutors have focused on three projects led by Meir, including HFZ’s flagship, a pair of spiraling towers designed by Bjarke Ingels at 76 11th Avenue called the XI.

Nir Meir, after being arrested in South Beach on an out-of-state fugitive warrant.

Photo: Miami-Dade County Corrections and Rehabilitation

In 2015, HFZ spent $870 million for the empty lot along the High Line — an ungodly sum for dirt — and contracted Omnibuild to oversee the XI building process. The same year, HFZ created an entity called 76 Eleventh Property Owner LLC to manage the hundreds of millions of dollars the firm raised to finance construction. HFZ and Omnibuild would use the LLC to pay dozens of contractors who, for example, poured concrete, installed windows, or put up Sheetrock. Prosecutors are now alleging that Meir transferred more than $253 million to other LLCs controlled by HFZ. From there, the government says, money improperly went to other company projects and into HFZ executives’ personal accounts. Prosecutors also allege that Meir and Omnibuild employees deceived the project’s lender into releasing new rounds of funding, with Meir instructing accountants to forge bank statements.

A second project that has drawn investigators’ scrutiny involves a long-coveted piece of land on 30th Street between Fifth and Sixth Avenues owned by Marble Collegiate Church. HFZ tapped Bjarke Ingels to design an office building there and enlisted Pavarini McGovern, another large firm, to oversee construction. Prosecutors allege that just as he had with the XI, Meir unlawfully moved $107 million out of the project’s LLC. In both cases, according to the government, Meir returned much of the money but came up short by tens of millions of dollars. He also allegedly forged documents and sent bogus wire-transfer information to Pavarini.

A third scheme described by the government is smaller — but, if proved, might be the most shameless. In early 2017, an investor called Arica Development lent HFZ $5 million to acquire and develop a property on Folsom Street in San Francisco. Prosecutors say that just $400,000 of the money went toward HFZ’s attempt to acquire the building, while $4.6 million was diverted to other HFZ projects. Meir then allegedly spent years lying to Arica, claiming the project was moving forward when, in fact, HFZ had failed to even close the deal to buy the building. Again, Meir allegedly sent fake documents and permits that made it seem like everything was proceeding as planned.

During this period, colleagues at HFZ described Meir as indefatigable, a savant with numbers and a master at finding and maintaining relationships with elite investors around the globe. He was always working, whether he was at pricey restaurants or exclusive clubs or hosting parties at his beachside mansion in the Hamptons. At the office, his authority couldn’t be questioned. As one former employee told me in 2022, “You can’t say no to Nir. If he asks you to transfer money to cover his AmEx, you have to pay it. If you don’t pay it, you’re going to get fired.”

As Meir dug HFZ into holes, he seems to have relied on increasingly desperate ploys to keep stakeholders at bay. In addition to allegedly lying to investors and forging documents, a lawsuit brought by Feldman in 2021 accused Meir of getting someone to pose as an investor during a conference call. As the real-estate newsletter The Promote recently described Meir, “Think of Adam Sandler’s Howie in Uncut Gems. Crank up the sketch, and you get close to the feeling.”

Investors and lenders weren’t the only ones Meir was allegedly bilking. Smaller contractors staked the future of their businesses on big HFZ jobs. One was Jan Efraimsen, who owned a millwork company in Yorktown Heights that HFZ contracted to work on a project on the Upper West Side. In early 2020, Efraimsen sent frenzied emails to an HFZ project manager demanding the firm pay an outstanding balance. “I am desperate for money right now — anything will work,” he wrote. “This is killing me,” he added. But the HFZ project manager didn’t have any answers. “I don’t want to string you along. Promises have been made before and not kept,” the HFZ employee eventually wrote back. Efraimsen has since retired. When I spoke to him in 2022, he told me he was forced to lay off three of his carpenters because HFZ hadn’t paid for the work his company performed.

In recent days, I called a handful of former HFZ employees to get their reactions to Meir’s arrest. None were surprised, but they did wonder why other top executives, like Feldman, had escaped indictment. (An attorney for Feldman and HFZ did not return a request for comment.) And one former employee questioned why prosecutors had chosen to focus on only three HFZ projects when, the employee suggested, they could have found evidence of wrongdoing in almost any of them.

Source link