How Much Does Instacart Pay?

I tried the Instacart full-service shopper side hustle for a week and didn’t hate it. I found the level of activity involved — shopping and loading at grocery and other types of stores — to be more fulfilling than chauffeuring people around as an Uber driver or doing taco and smoothie deliveries with DoorDash. (I tried both of those gigs, too).

Even though I liked it, I didn’t make much money, but that doesn’t mean you can’t. I chalk my struggle up to being a total Instacart noob and living in a relatively small town in Maryland. Also, I was filming my experience for a Nerdy video, which slowed me down a bit.

How much do Instacart shoppers make?

According to ZipRecruiter, the average pay for Instacart shoppers in Maryland is about $17 per hour. I made less than that.

I tested this side hustle over the course of three days, spent just under seven hours active in the app and earned a grand total of $80.29.

That’s $11.47 per hour.

It’s actually more like $8 per hour, when you consider the time I spent sitting in parking lots waiting for orders. By my estimate, I worked for 10 hours.

It’s even worse when you consider the 160 miles I put on my personal vehicle and half a tank of gas I used.

Let’s call it $25 for gas and subtract that from $80.29. I’m left with $55.29 for 10 hours of my time.

Here are some tips to help you make more than me, prepare to drive safely and pay taxes as an independent contractor.

Stay close to busy stores during peak times

As a full-service shopper, you earn pay each time you complete a “batch,” Instacart’s term for a delivery, which can include one or more customer orders and can be from multiple stores. Shop when it’s busy and you’ll get more opportunities to accept batches.

Signing up to make money with Instacart is super easy — meet basic requirements, have access to a vehicle and you’re basically in. Once you pass the background check, you can study the Instacart Shopper app to find busy stores in your area. The map in the app shows red or orange rings around busy stores. Head close to a color-coded store and you’re likely to get a batch.

I tested this side hustle during late morning and early afternoon hours on weekdays, which is all my schedule would allow, but it wasn’t the most profitable time to shop. In fact, the Shopper app showed Sunday as the only high-demand day of the week in my town, with the potential to earn an extra 25% between the hours of 3 p.m. to 7 p.m.

If I do this again, I’ll make time to go out on a Sunday to maximize my earning potential over a shorter period of time. I’d love to be able to make $50 to $75 bucks of side money for just a couple hours of work.

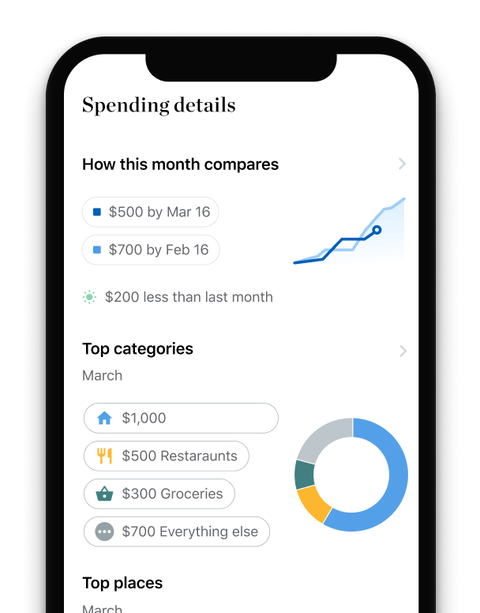

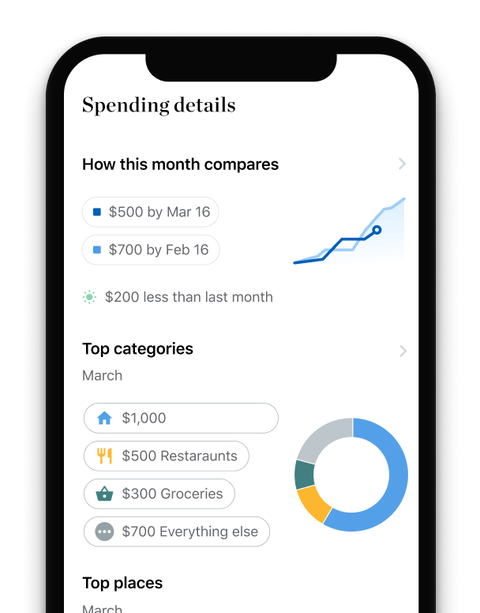

Track all the money you make

See the ins and outs of your cash, cards, and bank accounts at a glance.

Take orders that require more effort

The dollar amount you see when you accept a batch is made up of base pay (called batch pay), any available promotions and tips. According to Instacart’s website, the amount you earn per batch depends on the number of items, driving distance and effort involved when shopping and delivering. The harder the batch, the better the pay.

On the low end, I made $6.22 to shop for and deliver four items from a local grocery store to a customer who lived only a few miles away. On the high end, I made $21.63 for a multi-store batch to shop for two separate customers. I started at a pop-up Halloween store in the local mall to find and buy an adult-sized Binx costume (which I learned is a cat-like character from the movie “Hocus Pocus”), then made my way to a home improvement store to buy a rug and several other items for another customer. I spent an hour and 45 minutes and covered 16 miles on the batch.

You can make more money by accepting complex batches, but you’ll need to be quick to make it worth it.

Go the extra mile for customers

Part of the reason my two-store, double-customer batch took so long is because I spent half an hour hunting for a houndstooth rug.

The Shopper app prompts you to scan the barcode of each item as you shop. It is a good feature that helps you avoid mistakes, but the code on the rug I found didn’t match. Rather than skip it, I used the app to snap a pic and let the customer know I was buying the one I thought was right. I didn’t hear back, but when I got to the customer’s house, she greeted me and thanked me for staying the course. Later on, an app notification let me know she’d increased the tip by a dollar.

While an extra dollar isn’t much, customer tips can make up a significant portion of pay. In fact, $32 of the $80.29 I earned came from tips. Instacart advises new shoppers to focus on quality at the store — when picking produce, for example — bag items with care and communicate clearly with customers for higher tips.

Check your car insurance policy before you drive

Time to hit the road? Not so fast! Working as a full-service shopper for Instacart — like other driving gig jobs — makes you an independent contractor. It sounds cool, but being your own boss places extra responsibility on you when it comes to insurance and taxes.

Instacart’s website states that not all personal car insurance policies cover accidents that happen while on delivery, and that commercial insurance or special rideshare/delivery driver insurance may be required.

It’s important to read your policy and talk with your insurance company to find out what’s covered before you take your first delivery, says Bob Passmore, vice president of personal lines at the American Property Casualty Insurance Association.

“You’re looking for exclusions either specifically for delivery or for commercial activity,” he says. Other terms to look for in the policy include “carrying passengers for hire” or “carrying property for hire.”

Track your expenses to plan for taxes

Another thing to know before you go is what it’s like to pay taxes as an independent contractor. The IRS website clearly states that you have to file a tax return if you net $400 or more from self-employment work. Instacart provides full-service shoppers who earn $600 or more in a year a 1099-NEC (nonemployee compensation) for filing taxes.

At $80.29, I’m off the hook for now. But let’s say you’re killing it with Instacart. You should look into whether you need to make estimated tax payments. If you want to try to avoid making estimated payments, one strategy recommended by the IRS if you do gig work like Instacart on the side of a day job is to have more tax withheld from your employee paycheck.

You could also reduce what you owe in taxes through self-employment tax deductions. Be sure to keep good records so you can take advantage of mileage and other deductions — like phone costs — come tax time.

Drive safe and pack a lunch

Speaking of your iPhone or Android device, you’re going to be tethered to it while you work. You use it to accept orders, locate and scan the barcodes of items in the store, navigate to the customer and basically log everything you do. Bring a charger and invest in a good phone mount for your car to make it safe and easy to follow directions.

Also, this side gig requires physical activity. You’ll be walking, searching for elusive gourmet grocery items, lifting heavy stuff like pet food and driving all over the place. Bring enough water and a sack lunch to stay fueled up and avoid spending your batch pay as soon as you get it.

Track all the money you make

See the ins and outs of your cash, cards, and bank accounts at a glance.

Source link

:max_bytes(150000):strip_icc()/GettyImages-2209884194-b65b782319024eb68112472701e34335.jpg?w=390&resize=390,220&ssl=1)

:max_bytes(150000):strip_icc()/GettyImages-22027001041-3792d4dba58e4d5caf5c839b3d0979f5.jpg?w=390&resize=390,220&ssl=1)