MicroCloud Hologram’s stock surges, but don’t call it a short squeeze

Shares of MicroCloud Hologram Inc. rocketed toward a record gain on record volume Wednesday, just days after a reverse stock split took effect that helped lift the price back above the key $1 level.

The Beijing-based holographic-technology company

HOLO,

on Wednesday announced plans to join the Communications Industry Association, a nonprofit social and economic group that promotes technological innovation and export.

The news would hardly seem worthy of fueling a 1,092% rally in the stock on volume of 193 million shares during regular trading hours. The previous record for a one-day gain was 51.7% on Jan. 6, 2023, and the record for one-day volume was 5.3 million shares on Sept. 19, 2022.

The company did not immediately respond to a request for comment or information.

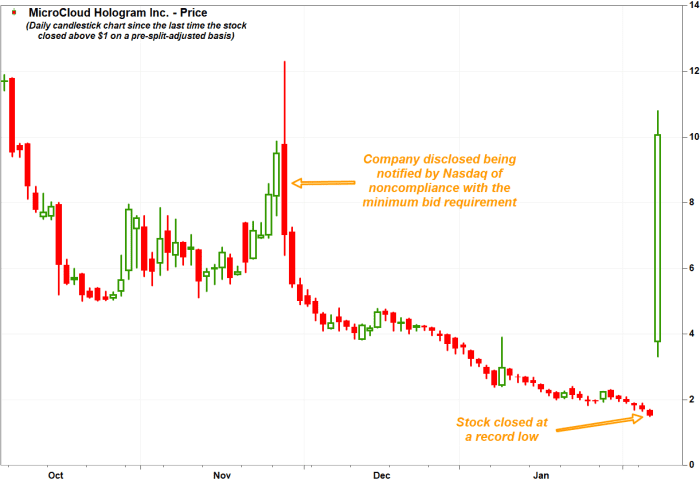

What a 567% stock rally looks like.

FactSet, MarketWatch

Many are quick to cite “short covering,” or the closing of bets that the stock would fall, as the reason a stock that has been trending sharply lower — MicroCloud Hologram’s closed at a record low on Tuesday — rallies for no apparent reason. (Read more about the mechanics behind a short sale.)

But based on observations made by Ihor Dusaniwsky, managing director of financial analytics at S3 Partners, this rally shouldn’t be called a short squeeze.

Short interest as a percentage of public float is relatively high at 12.5%. That’s in comparison with the original meme stock, AMC Entertainment Holdings Inc.

AMC,

which closed Monday at a record low and has 9.2% of its float shorted.

But Dusaniwsky stressed the stock is “extremely lightly shorted,” as the value of short interest is just $210,000 with only 139,000 shares shorted.

“Can’t see how 139K of shorts has any effect on [145] million shares of trading today,” Dusaniwsky said.

The stock’s rally comes after a 1-for-10 reverse stock split was enacted on Friday. The split, which has no effect on the company’s fundamentals, multiplies the stock price by 10, by reducing the number of shares outstanding by a factor of 10.

“The reverse stock split is undertaken with the objective of meeting the minimum $1.00 per share requirement for maintaining the listing of the ordinary shares on Nasdaq,” the company said in a statement.

The company disclosed on Nov. 28 that it had been notified by the Nasdaq that the stock price didn’t comply with the minimum-bid requirement.

The stock closed at $1.83 on Feb. 2, which would equate to a pre-split adjusted price of 18.3 cents.

On Tuesday, the stock closed at a split-adjusted record low of $1.51. It had plummeted 87% since Oct. 6, 2023, when it last closed above $1 on a pre-split-adjusted basis.

Source link

:max_bytes(150000):strip_icc()/INV_StrategicPetroleumReserve_GettyImages-1434804700-930b2f63ac494dccb1223603d993391a.jpg?w=390&resize=390,220&ssl=1)

:max_bytes(150000):strip_icc()/latestGainersLosers-da3dc30744c44554b28966c4ea038d8e.png?w=390&resize=390,220&ssl=1)

:max_bytes(150000):strip_icc()/GettyImages-2141342223-30fa8b1e69564581aab5dd8c7ca34dae.jpg?w=390&resize=390,220&ssl=1)