Split the Bill, Avoid the Headaches With These Credit Cards and Apps

You’re out to dinner with friends and the bill arrives. Cue the dreaded questions like: “Should we split the bill to make it easier? Should we only pay for what we ordered?”

If you typically order just the side salad, you might welcome a tool that keeps these questions at bay. Alternately, if you’re the first to raise your hand to cover the entire check (and reap the credit card rewards), you may also appreciate an easy way to break down who owes you what, ensuring you’re not short-changed.

Helpfully, various credit card features and third-party apps can facilitate the tracking of shared expenses and sending or receiving payments among friends or family. These services can streamline the process of splitting bills with others, whether it’s a large restaurant tab, a group vacation, a rent or utility payment among roommates, or something else.

Some of these services may require you and those in your group to sign up. For instance, you may need to have PayPal or Venmo to be able to send or request money through another app. But the barrier to entry is low, and they’re typically free to use.

Splitting the check with others

The following services are available for use via Android and iPhone devices:

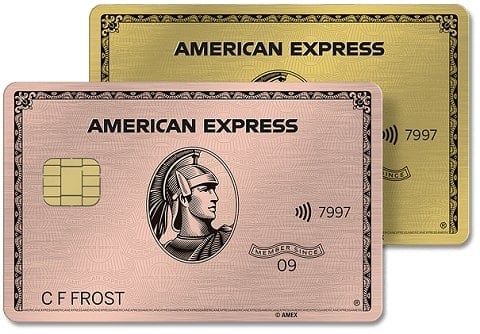

AmEx Send and/or AmEx Split

American Express credit cardholders can use these options to conveniently divide costs among friends or family members, even those who aren’t AmEx cardholders themselves:

AmEx Send allows you, as an AmEx cardholder, to pay any other Venmo or PayPal user, for no fee — helpful if you happen to be short on cash in that moment and aren’t near an ATM. You can send money from your AmEx app or directly from the Venmo or PayPal app.

AmEx Split lets you cover a purchase with your AmEx card and then divide the cost among other Venmo or PayPal users. You can get reimbursed either as a statement credit to your AmEx card or as a payment into a PayPal or Venmo account. You’ll earn rewards as you normally would when using your card, and the app crunches the numbers and keeps track of incoming or pending payments.

Enrollment is required; terms apply.

Venmo

The Venmo Credit Card has a unique QR code that links to your Venmo account. Your friends or family can scan it to cover their portion of a purchase, meaning you could settle up before even leaving the restaurant booth.

The Venmo Groups feature also permits splitting bills with a group in the Venmo app when you add your friends and fill in the expenses. Keep in mind that if you pay with a credit card through this service, there is a 3% fee.

Splitwise

As the name suggests, the Splitwise app lets you split expenses and keep track of pending payments, though it does require a little legwork upfront.

You’ll have to sign up for an account, create a group for ongoing expenses or add one-time expenses, and then add the contact information for the members you want to split a purchase with.

To send a payment, you can use PayPal or Venmo through the Splitwise app. Splitwise won’t charge processing fees, but Paypal and Venmo will charge a processing fee if you use a credit card to send money this way.

Tab

Tab allows you to claim the specific items you purchased from an uploaded photo of a receipt. It also offers a variety of different functions that might be helpful, depending on the need.

For instance, if you split a purchase like an appetizer or something else, multiple people can select the same item to cover the cost. If it’s someone’s birthday, you can also split the total evenly among everyone else to cover the person of honor’s celebration meal.

Tax and tip are calculated for everyone in the app and divided proportionally. Those sharing an expense with you will need the app to divide the costs and join the same bill from their own phones.

Best rewards credit cards for covering a large bill

One way to maximize rewards is to offer to cover the bill in a group setting, whether it’s for dining out, travel or other expenses.

But the strategy is ideal only if you know for sure that you’ll be reimbursed by your friends or family and you can pay off the balance in full to avoid interest charges. Otherwise, the costs will outweigh the benefits.

At restaurants

When you’re covering the bill and getting reimbursed by friends or family through other apps, a card like the Capital One Savor Cash Rewards Credit Card is a good top-of-wallet pick. It earns 3% back on dining, grocery stores and entertainment (including streaming services), and 1% back on all other purchases, all for a $0 annual fee.

The American Express® Gold Card is another top choice for dining expenses, especially if you’re planning to use the AmEx Send or AmEx Split feature.

Among other bonus categories, the card earns 4 Membership Rewards points per dollar spent at restaurants on up to $50,000 in purchases per year. It has a $325 annual fee, but that can be worth paying if you can make use of the card’s various incentives to offset the cost.

For travel

If you value the flexibility to book travel and redeem rewards with any brand, a card like the Chase Sapphire Preferred® Card may help advance your vacation goals, especially if you use it to book group travel. It earns 5 points per $1 spent on travel purchased through Chase’s travel portal; 3 points per $1 spent on dining; 3 points per $1 spent on select streaming services; 3 points per $1 spent on online groceries, 2 points per $1 spent on all other travel purchases; and 1 point per $1 spent on all other purchases. There’s also a $50 annual hotel credit when you book through Chase’s travel portal, which can defray the cost of a night’s stay. The card’s trip cancellation or interruption insurance may also reimburse some of the costs if your travel plans get derailed for an eligible reason. It has a $95 annual fee, which again can be offset by the card’s many perks.

For rent and utilities

For some group expenses, it may cost extra to use a credit card, thanks to processing fees. But for rent, at least, there’s an exception. The Bilt World Elite Mastercard® Credit Card earns 1 point per $1 spent on rent, up to 100,000 points per calendar year, as long as you pay through the card’s app, and as long as you put at least five purchases on the card per billing cycle. It doesn’t impose any extra fees or surcharges on those transactions, and there’s also no annual fee. So you could use the card to cover the rent, get reimbursed by your roommates, and collect rewards on top of it all.

Speaking of rewards, the card also earns 5 points per $1 spent on Lyft; 3 points per $1 spent on dining; 2 points per $1 spent on travel; and 1 point per $1 spent on all other purchases.

When you don’t have to worry about processing fees for certain utilities, you can consider a card like the Wells Fargo Active Cash® Card. It earns 2% cash back on all eligible purchases, which can add up over time.

Source link

:max_bytes(150000):strip_icc()/GettyImages-2180164279-a396e9e8baf740bb94063973444dc500.jpg?w=390&resize=390,220&ssl=1)

:max_bytes(150000):strip_icc()/GettyImages-22249452531-b3e13f5a3ca742c598fee63e9432d7cf.jpg?w=390&resize=390,220&ssl=1)